Top 3 Year-End Tax Saving Strategies for Georgia Business Owners (Without Buying Equipment)

The holidays are here and everyone’s getting their Christmas lists ready. Toys for the baby, something nice for your partner, and tax deductions for your business. Before you panic-buy that truck or piece of equipment you’ve been eyeing (and don’t really need), let’s talk about three smarter ways to save on taxes before year-end.

While you can save a significant amount on taxes purchasing equipment, today we’re going to talk about 3 tax strategies that you can implement without incurring major expenses before year-end. The best part is that you can accomplish these strategies simply by doing things slightly differently than you’re already doing them today.

For our blog, our test subjects will be Chris & Erin Williams, both age 45. The Williams own an S-Corp earning $1,000,000 in net income and pay Chris (a software engineer) $150,000.

Quick Answer: Georgia business owners can save significant taxes through (1) QBI deduction optimization via strategic W-2 planning, (2) Georgia PTET election for full state tax deductibility, and (3) retirement plan optimization. These strategies require no equipment purchases and must be implemented by December 31, 2025.

Qualified Business Income (QBI) Deduction Maximization for Georgia Businesses

The Qualified Business Income (QBI) Deduction is a deduction available to the owners of passthrough entities Sole Proprietors, Partnerships, S-Corps.

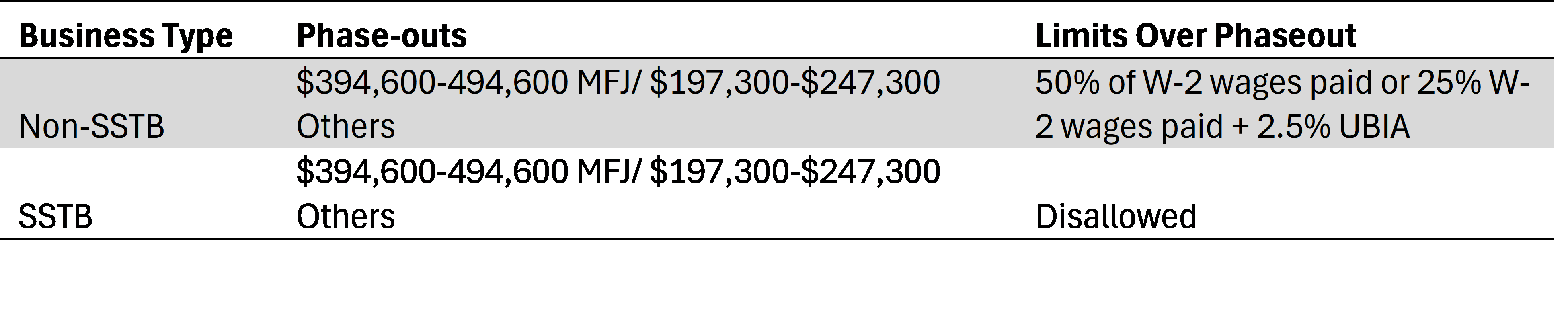

The QBI Deduction is a 20% deduction on your qualified business income, capped at 20% of your taxable income (minus capital gains). However, it begins to phase out at:

- $394,600 taxable income (MFJ)

- $197,300 for all other filers

The deduction fully phases out at:

- $494,600 taxable income (MFJ)

- $247,300 for all other filers

If you are over the limit, you may still be eligible for a deduction based on wages paid and unadjusted basis. Your QBI Deduction will be limited to the higher of:

- 50% of your W-2 wages paid

- 25% of your W-2 wages paid + 2.5% of unadjusted basis of qualified property (UBIA)

These phaseouts have different, stricter rules if you are a “Specified Service Trade or Business.” The easiest way to explain SSTBs is that they are businesses that rely on the personal services of their owners – think accountants, financial planners, doctors, lawyers, and more. IRS definition here.

If you are an SSTB, like a doctor, lawyer, accountant, or consultant, you are not eligible for any QBI deduction once you exceed the phaseout limit ($494,600 for MFJ), no matter how much you pay in W-2 wages. However, Chris and Erin's software business is NOT an SSTB, so they can use the wage limitation strategy.

QBI Phaseout Rules by Business Type

So, as you can see, the QBI Deduction is a highly valuable deduction available to business owners. However, while everyone knows it exists, very few people focus on maximizing their QBI deduction. The interaction between W-2 wages and QBI allows for significant tax planning opportunities.

Oftentimes, people setup an S-Corp and keep their W-2 wages as low as possible to avoid FICA taxes. This can be counterproductive, as it may limit your QBI deduction as well as cause reasonable compensation issues.

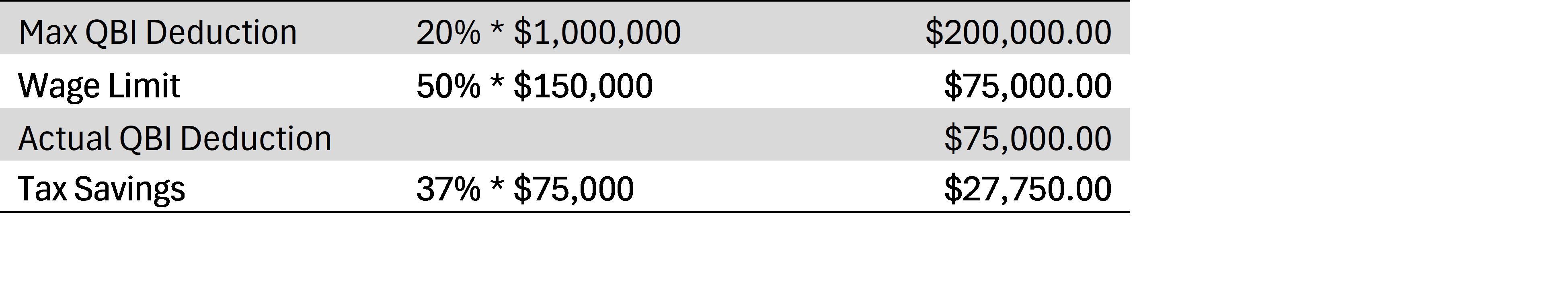

Example: The Williams Family

The Williams have an S-Corp where W-2 wages total $150,000, and their $1,000,000 business income places them well over the phaseout limit. Chris’s reasonable salary should be closer to $250,000.

Current Scenario

Chris’s artificially low W-2 wages are costing them a significant amount in QBI Deductions.

Year-End Bonus Strategy

One way for them to generate additional QBI Deduction would be to pay Chris a year-end bonus.

While the Williams will have to pay more in FICA taxes, these costs are more than made up for in additional QBI Deductions. W-2 wages must be paid by December 31st. You cannot retroactively increase wages next year.

By being proactive at year-end, looking at the whole picture, and without any major new expenses, you can generate a significant amount in tax savings through QBI Deduction Maximization.

Reasonable Compensation Rule

Important note on reasonable compensation: The IRS expects S-Corp owners to pay themselves reasonable compensation for the work they perform. Increasing W-2 wages from $150,000 to $250,000 for Chris is defensible given his role (software engineer), but you can't jump from $50,000 to $500,000 just for QBI benefits. Base your W-2 wages on what you'd pay someone else to do your job.

Georgia PTET Election: How to Deduct State Taxes on Your Federal Return

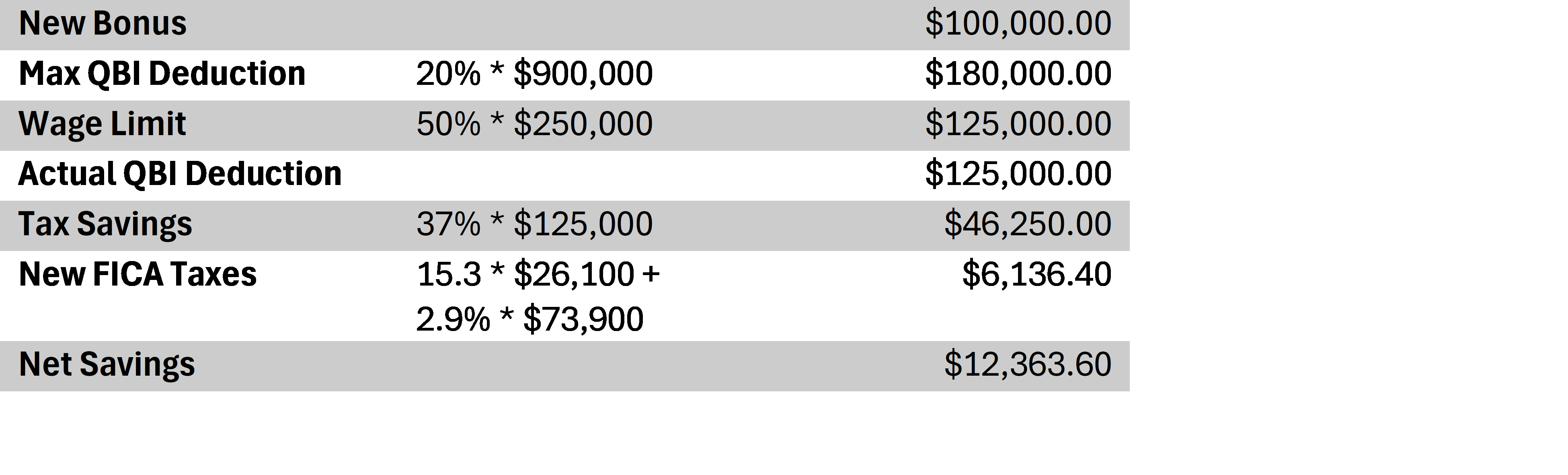

Now that we’ve tackled QBI, let’s talk about another deduction that you can realize by simply doing things a little differently. After the Tax Cuts & Jobs Act, individuals were limited to including $10,000 of their state taxes as an itemized deduction on their federal return. States across the country came up with various methods to allow owners of pass through entities to still fully deduct their state income taxes. These were called Pass Through Entity Tax Elections or PTET elections.

With the passing of The One Big Beautiful Bill Act, the state tax deduction limit for individuals increased to $40,000, but this only applies under $500,000 in MAGI and fully phases out at $600,000 in MAGI.

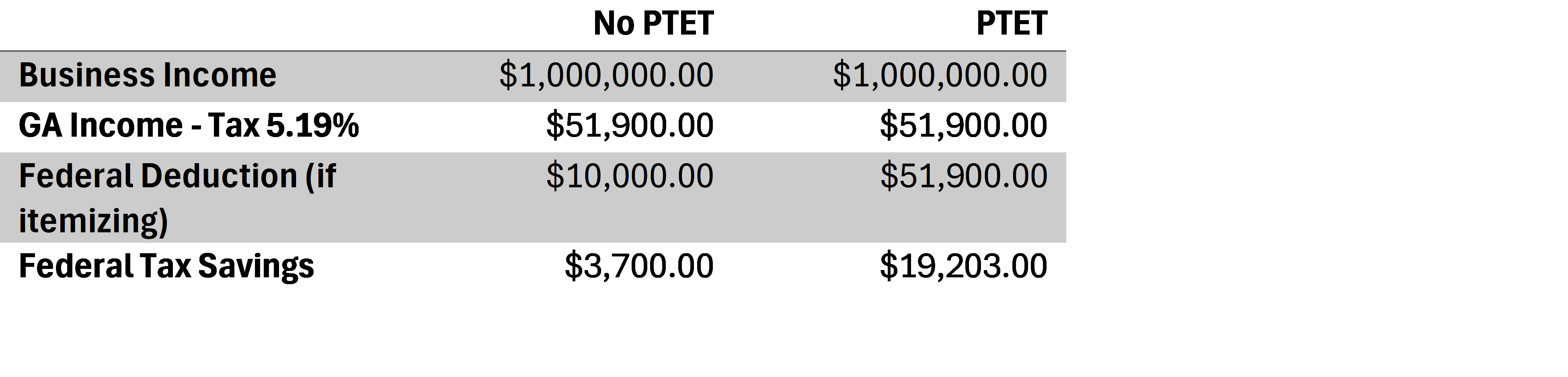

SALT vs PTET Comparison

For high-income business owners in Georgia, the PTET is still essential.

Example: The Williams Family

In Georgia, the PTET election allows you to pay your state income taxes through the business, creating a business expense. Then your expense is written off on your federal taxes, resulting in tax savings.

These savings are only possible with PTET, otherwise only $10,000 of state taxes would be deductible.

The PTET election requires:

- Setting up a Georgia tax account

- Paying estimated taxes through the business

- Making the election on the return

The PTET election is a no-brainer for Georgia business owners earning over $500k. You’re already making these tax payments, so why not make them tax-deductible? Once again, more tax savings without significant changes in your life!

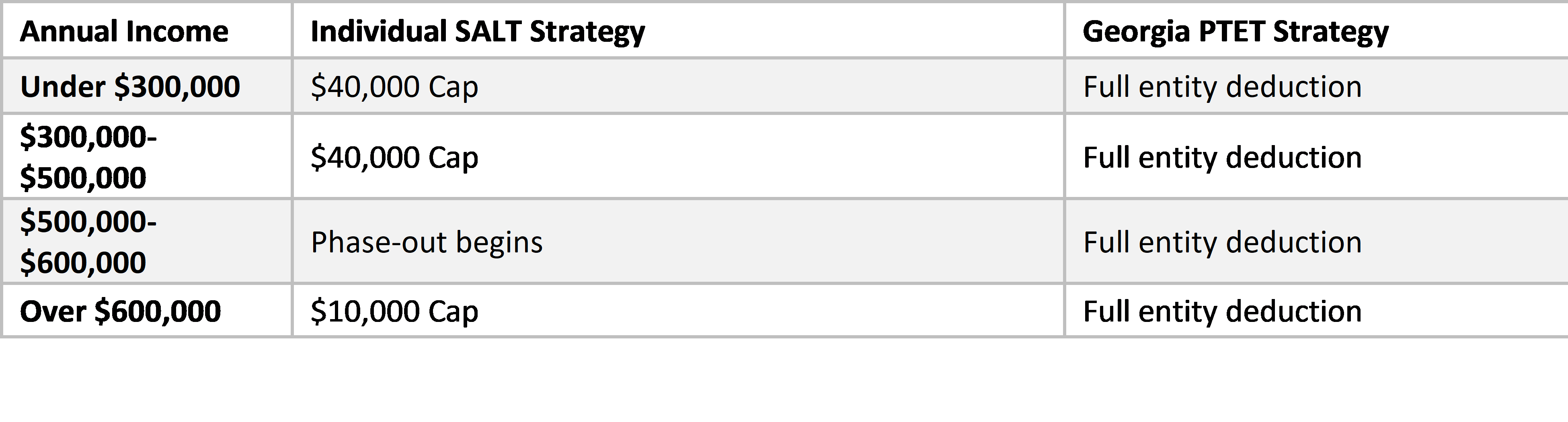

Solo 401(k) vs SEP IRA: Best Retirement Plan for Georgia Business Owners

Every business owner should be saving for retirement. To help do that, there are several types of retirement plans available to small business owners – SIMPLE IRAs, SEP IRAs, 401(k)’s, defined benefit plans and more.

Typically, most small business owners start with the easiest option, the SEP IRA, due to ease of use and higher contribution limits. SEP IRAs allow business owners to make tax-deductible contributions up until their filing deadline. These amounts can be set each year by the business depending on business performance, making them very low maintenance.

While many default to a SEP IRA, that’s not always the best choice.

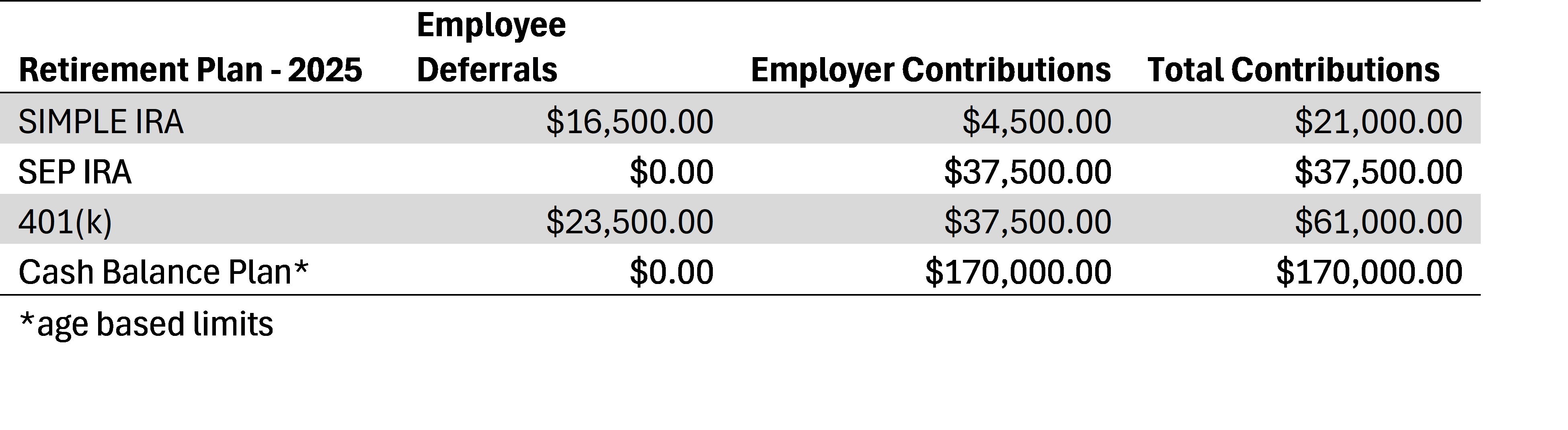

Retirement Plan Comparison (2025)

Let’s review a few different options and the maximum annual contribution for the Williams family based on their income:

The Solo 401(k) beats the SEP IRA at the same income level and has minimal startup requirements.

The cash balance plan paired with a 401(k) is far and away the best option for the Williams, but it does have some startup and ongoing administrative costs. It also requires that you fund it for a few years which means it may not work for everyone

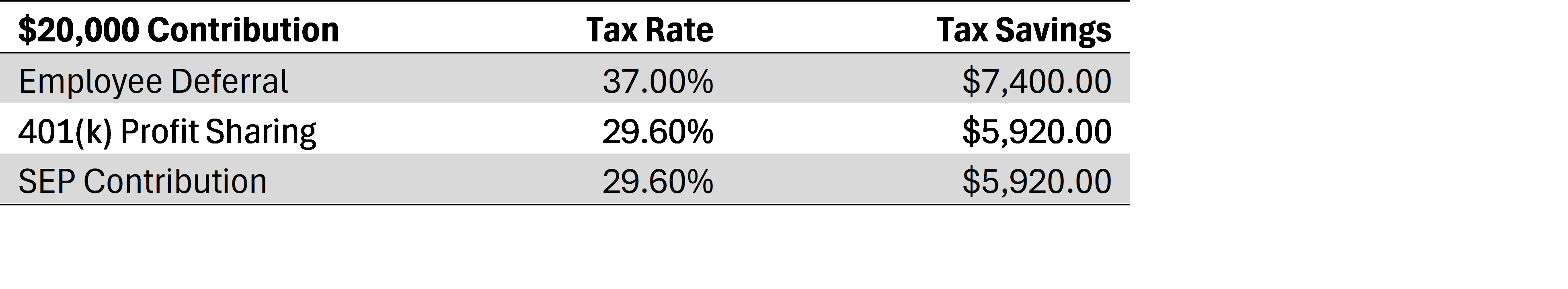

Tax Savings Comparison

A Solo(k) may not only provide higher contribution limits for business owners, but the tax deductions can generate higher tax savings than a SEP IRA.

This is because the employee deferrals don’t reduce your QBI. SEP Contributions and SOLO(k) Profit Sharing Contributions both reduce your QBI. While all contributions can be a net positive, the tax impact of the employee deferrals is higher.

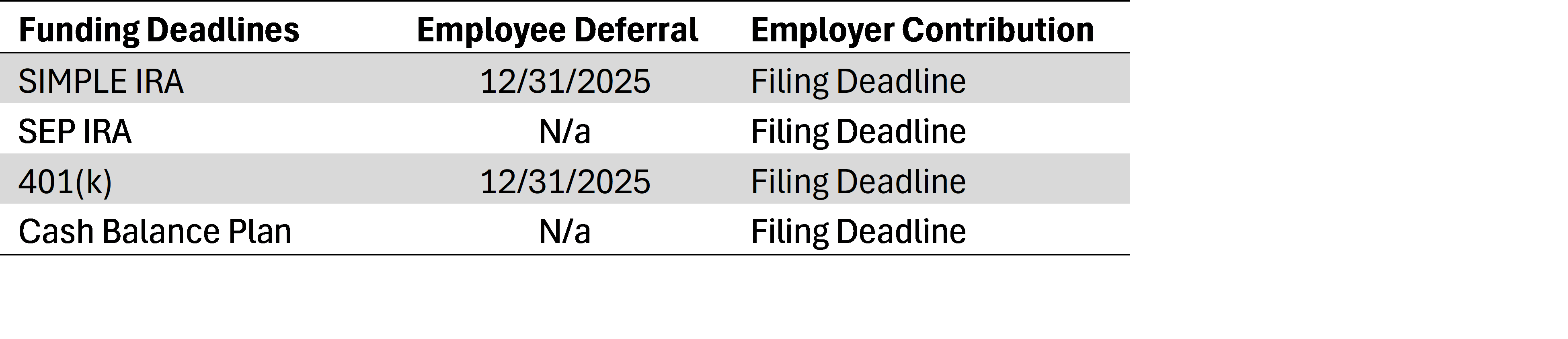

Retirement Plan Funding Deadlines

The reason that timing matters so much is that the employee deferrals must be run through payroll if you are an S-Corp. Thus, because payroll must be run by December 31st, those contributions are lost if payroll isn't run by the end of the year.

If you want to do things the best possible way, planning for savings before the end of the year is the only way to do it.

Summary

Year-end tax planning doesn’t have to mean panic-buying equipment you don’t need. By:

- Maximizing your QBI deduction

- Electing the Georgia PTET

- Setting up the right retirement plan

Georgia business owners can unlock significant tax savings before December 31st, with no major purchases required.

The key is acting now:

- W-2 bonuses must be paid by 12/31

- PTET estimated payments must be made before year-end

- 401(k) employee deferrals must run through payroll by 12/31

Waiting until January to talk to your accountant means these opportunities are gone.

Ironclad Wealth Management works with small business owners in Georgia who are tired of overpaying taxes and want proactive, year-round planning. We provide comprehensive financial planning that integrates tax strategy, business protection, and investment management to help you keep more of what you earn and reach your financial goals faster.

Ready to implement these strategies before year-end?

December 15th is our last day for year-end planning sessions.

Schedule Your Year-End Tax Strategy Session

Join our weekly newsletter:

- Money & business tips for entrepreneurs

- Financial education

- Relevant news